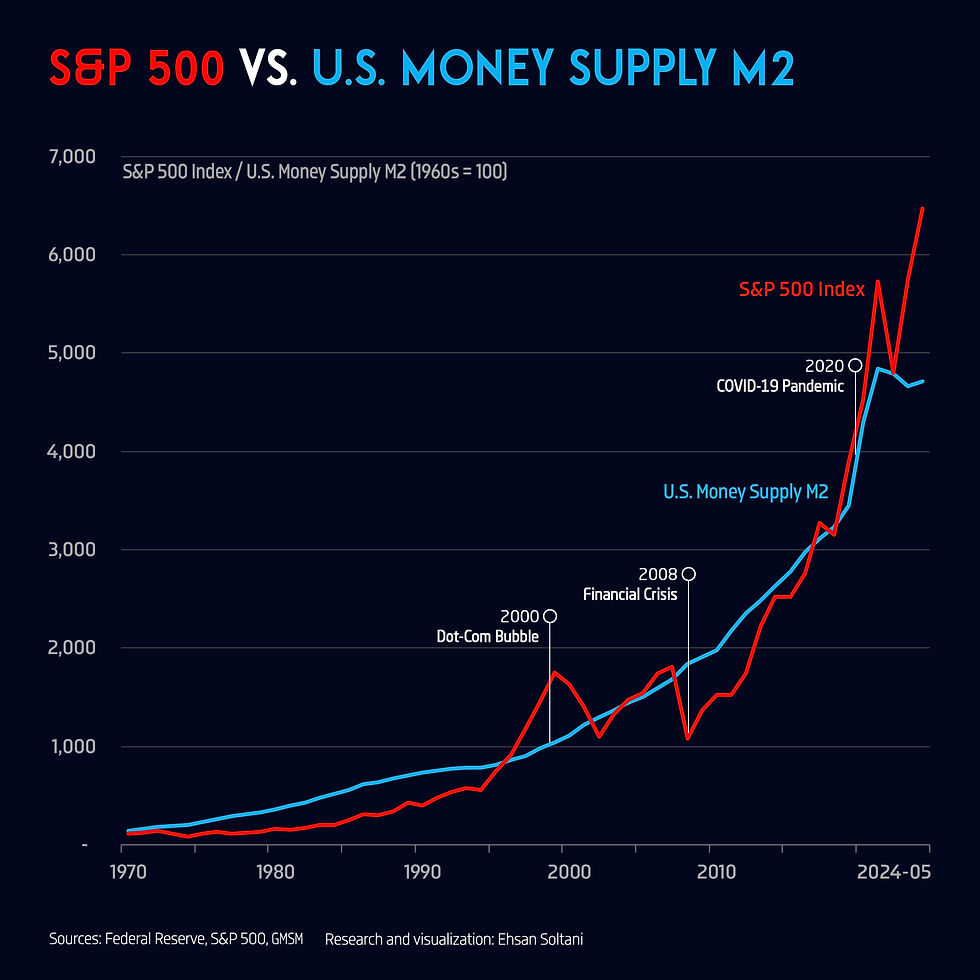

📈 S&P 500 vs. U.S. Money Supply M2 (1970–2024/05)

- Admin

- Jul 4, 2024

- 1 min read

The analysis of the S&P 500 Index and U.S. Money Supply M2 from 1970 to May 2024 reveals a general upward trend for both indices, with the Money Supply M2 showing stable growth and the S&P 500 Index exhibiting higher volatility. The correlation between the two suggests that while increases in the money supply can contribute to stock market growth, other factors play a significant role in driving market fluctuations. This highlights the complexity of financial markets and the multitude of influences on stock prices beyond just monetary supply.

-.png)

ความคิดเห็น